Corporate Governance

(Stance and Approach)

Basic Concept

SEKISUI CHEMICAL Group's basic corporate governance policy is to achieve sustainable growth and increase corporate value over the medium to long term.

To achieve this, we are increasing management transparency and fairness and pursuing swift decision-making. At the same time, we will continue to meet the expectations of our five stakeholders-customers, shareholders, employees, business partners, and local communities and the global environment-through the creation of social value as stated in our Corporate Philosophy.

SEKISUI Corporate Governance Principles

The Company has established and disclosed the SEKISUI Corporate Governance Principles for the purpose of further evolving its corporate governance initiatives and communicating its corporate governance approach and initiatives to stakeholders.

In addition to the above Principles, the status of the Company’s initiatives and its approach with respect to the Corporate Governance Code, consisting of the General Principles, Principles, and Supplementary Principles, are summarized and disclosed in the Initiatives to Each of the Principles of the Corporate Governance Code.

Details of SEKISUI CHEMICAL Group’s Corporate Governance Report, SEKISUI Corporate Governance Principles, and Initiatives to each of the Principles of the Corporate Governance Code are available at the following address.

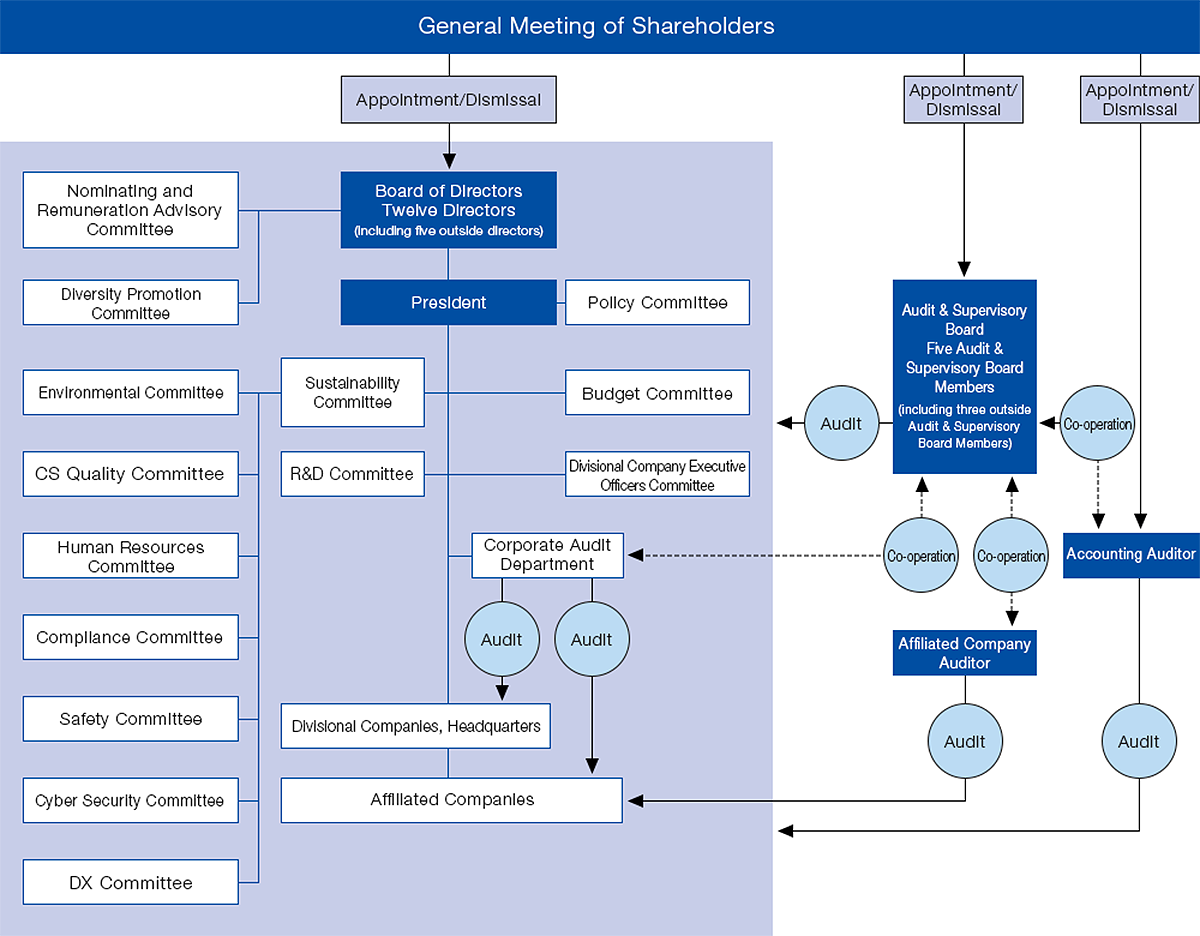

Organizational Structure

SEKISUI CHEMICAL has chosen a company with an Audit and Supervisory Board as its organizational structure under the Companies Act. Under the Divisional Company Organization System, we have adopted the Executive Officer System in order to separate the supervisory function of directors from the business execution function of executive officers and to ensure each divisional company responds swiftly to changes in the business environment.

| Organizational structure | A company with an Audit and Supervisory Board |

|---|---|

| Total number of Directors | 12 (In-house: 7; Outside: 5) * Three of whom are female |

| Ratio of Outside (independent) Directors | 41.7% |

| Ratio of female Directors | 25.0% |

| Director’s term of office | 1 year |

| Executive Officer system introduced | Yes |

| Organization to assist the president in making decisions | Policy Committee |

| Voluntary advisory board to the Board of Directors | Nomination and Remuneration Advisory Committee and Diversity Promotion Committee established |

- 16-02

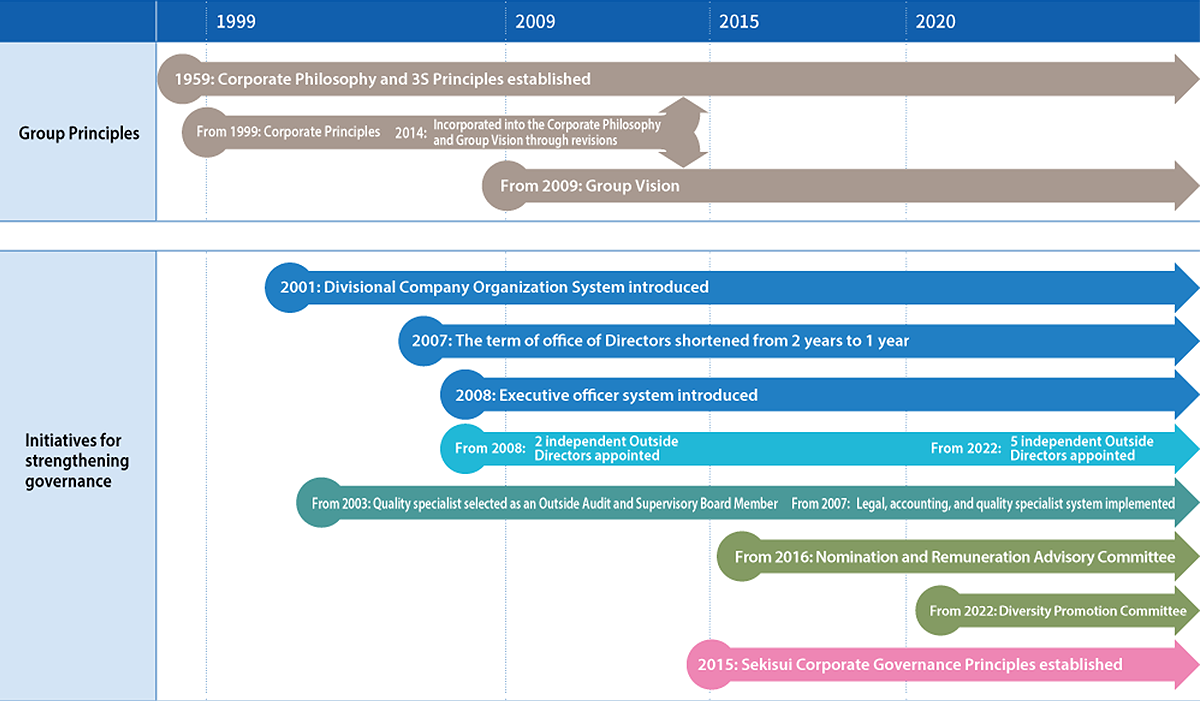

Initiatives Taken to Enhance Corporate Governance

- 16-03

Corporate Governance System Chart (As of March 31, 2024)

Roles and Responsibilities of the Board of Directors

The Board of Directors is positioned as the body that determines basic Group-wide policies, makes sophisticated management decisions, and supervises the execution of business.

The Company’s Chairman, who is a non-executive director, serves as the Chairman of the Board of Directors. In addition, the Company has established a highly effective supervisory system for directors by appointing outside directors with sufficient independence to ensure management transparency and fairness.

As a general rule, directors are required to attend all of the meetings of the Board of Directors.

Composition of the Board of Directors

We have limited the number of directors to 15, of which several outside directors are to be appointed.

Our Board of Directors is made up of directors with excellent character, insight, and high ethical standards, as well as knowledge, experience, and relevant capabilities.

In addition, all Audit and Supervisory Board members, including outside Audit and Supervisory Board members, attend meetings of the Board of Directors. At least one Audit and Supervisory Board member is appointed with knowledge of corporate finance and accounting, and at least one is appointed with knowledge of the legal system. The diversity and number of Board of Directors’ members is set to ensure that appropriate decisions are made in accordance with the scope and size of our business.

The presidents of the divisional companies, who are the top management of each business and senior corporate officers with significant experience and strong expertise, are appointed as inside directors. Together with the independent outside directors, who have broad knowledge and experience, and Audit and Supervisory Board members with strong expertise, the presidents of the divisional companies effectively perform the roles and responsibilities of the Board of Directors and maintain a balance with respect to diversity, optimal size, and capabilities. Following their initial appointment to the Company’s Board of Directors at the Annual General Meeting of Shareholders held in June 2022, three female directors have been continuously reappointed.

In light of the above, we believe that the diversity of our Board of Directors is ensured in terms of both skills and gender.

Attendance of Directors and Audit and Supervisory Board Members

| Name | Position in the Company |

Years in office(June 2024 as of the conclusion of the Annual General Meeting of Shareholders) | Attendance at Board Meetings (FY2023) |

Attendance at Audit and Supervisory Board Meetings (FY2023) |

Attendance at Nomination and Remuneration Advisory Committee Meetings (FY2023) |

Attendance at Diversity Promotion Committee Meetings (FY2023) |

|---|---|---|---|---|---|---|

| Teiji Koge | Chairman of the Board | 19 years | 100% (17/17) |

- | 100% (6/6) |

100% (3/3) |

| Keita Kato | President and Representative Director CEO |

10 years | 100% (17/17) |

- | 100% (6/6) |

100% (3/3) |

| Futoshi Kamiwaki | Representative Director Senior Managing Executive Officer | 4 years | 100% (17/17) |

- | - | 100% (3/3) |

| Yoshiyuki Hira | Director Senior Managing Executive Officer |

9 years | 100% (17/17) |

- | - | - |

| Toshiyuki Kamiyoshi | Director Senior Managing Executive Officer |

5 years | 94% (16/17) |

- | - | - |

| Ikusuke Shimizu | Director Senior Managing Executive Officer |

5 years | 100% (17/17) |

- | - | - |

| Kazuya Murakami | Director Executive Officer |

3 years | 100% (17/17) |

- | - | 100% (3/3) |

| Hiroshi Oeda | Independent Outside Director | 6 years | 100% (17/17) |

- | 100% (6/6) |

100% (3/3) |

| Haruko Nozaki | Independent Outside Director | 2 years | 94% (16/17) |

- | 100% (6/6) |

100% (3/3) |

| Miharu Koezuka | Independent Outside Director | 2 years | 100% (17/17) |

- | 100% (6/6) |

100% (3/3) |

| Machiko Miyai | Independent Outside Director | 2 years | 100% (17/17) |

- | 100% (6/6) |

100% (3/3) |

| Yoshihiko Hatanaka | Independent Outside Director | 1 year | 100% (13/13) |

- | 100% (5/5) |

100% (3/3) |

| Hiroyuki Taketomo | Full-time Audit and Supervisory Board Member | 3 years | 100% (17/17) |

100% (14/14) |

- | - |

| Tomoyasu Izugami | Full-time Audit and Supervisory Board Member | 1 year | 100% (13/13) |

100% (11/11) |

- | - |

| Yoshikazu Minomo | Independent Outside Audit and Supervisory Board Member | 2 years | 100% (17/17) |

100% (14/14) |

- | - |

| Wakyu Shinmen | Independent Outside Audit and Supervisory Board Member | 1 year | 100% (13/13) |

100% (11/11) |

- | - |

| Kenji Tanaka | Independent Outside Audit and Supervisory Board Member | 1 year | 100% (13/13) |

100% (11/11) |

- | - |

About the Age-group Composition of Officers

| Under 30 | 30-39 | 40-49 | 50-59 | 60 or older | ||

|---|---|---|---|---|---|---|

| Number of Director by Age |

Male | 0 | 0 | 0 | 2 | 7 |

| Female | 0 | 0 | 0 | 0 | 3 | |

- Note: As of March 31, 2024

Outside Director

We have appointed independent outside directors with a wealth of management experience and expertise across different backgrounds to provide oversight and advice and to contribute to the enhancement of our corporate value. In particular, we receive advice from a variety of objective perspectives on such priority management issues as global expansion, business model innovations, and the strengthening of ESG management.

Hiroshi Oeda, Outside Director

Haruko Nozaki, Outside Director

Miharu Koezuka, Outside Director

Machiko Miyai, Outside Director

Yoshihiko Hatanaka, Outside Director

Assessment Relating to the Board's Effectiveness

Every year, the Company conducts a survey to evaluate the effectiveness of the Board of Directors for directors and Audit and Supervisory Board members, and to evaluate the effectiveness of the Board of Directors.

Based on the results of the survey, the Company confirmed that the Board of Directors set appropriate agenda items, ensured sufficient time for discussion, and allowed directors and Audit and Supervisory Board members, including outside directors, to actively offer their opinions and suggestions. For this reason, we believe that our Board of Directors contributes to enhancing the corporate value of the Group and is functioning properly.

In fiscal 2023, the Board of Directors thoroughly deliberated on key management issues, including growth strategies (R&D, new large-scale businesses, large-scale capital expenditures, etc.) and fundamental strategies (Sustainability Committee reports, digital transformation, safety, compliance, CS & Quality, etc.).

The Nomination and Remuneration Advisory Committee deliberates on the selection of candidates for directors and Audit and Supervisory Board members, as well as individual assessments and amount of compensation. Thereafter, the Board of Directors deliberates on the results. The Nomination and Remuneration Advisory Committee met six times, and held discussions on a variety of issues, including the composition and effectiveness of the Board of Directors and initiatives to strengthen governance.

Support for and Collaboration with Directors and Audit and Supervisory Board Members

In order to enhance deliberations at meetings of the Board of Directors, materials for meetings are distributed in advance and prior explanations are provided by the executive officer in charge of the Secretariat. In addition, we provide opportunities to deepen understanding of our business on an ongoing basis through orientation at the time of appointment, business briefings and site visits multiple times a year.

In order to further enhance the effectiveness of management oversight by outside executives, the Nomination and Remuneration Advisory Committee, which is composed of a majority of outside directors, has enhanced its deliberations. In addition, dialogue with Audit and Supervisory Board members and accounting auditors is also conducted. In terms of succession planning, we are also strengthening contact between the current management team and candidates for the next management level. For example, we offer lectures by outside directors at Executive Officers Liaison Committee meetings, which are held at the time of each quarterly settlement of accounts, and provide opportunities for directors, Audit & Supervisory Board members, and executive officers to come together when establishing a new management system after the Annual General Meeting of Shareholders.

Opportunities to Deepen Understanding of the Company's Business

In order to deepen understanding of the Company and the characteristics of the Group’s wide-ranging business, we conduct business site inspections by outside executives each year and business briefings for outside officers.

In fiscal 2023, we inspected the core plants of each divisional company (Housing Company: Sekisui Heim Industry Co., Ltd.; Urban Infrastructure & Environmental Products Company: Shiga-Ritto Plant; High Performance Plastics Company: Musashi Plant and Shiga-Minakuchi Plant), as well as Asaka Lead Town and the High Performance Plastics Company’s MINASE INNOVATION CENTER.

Grasp External Trends on Economic, Environmental, and Social Topics

We share details of earnings announcements at Executive Officers Liaison meetings held at the time of each quarterly settlement. In addition, we invite speakers from outside the company to provide the latest information on economic, environmental, and social trends that are directly related to management issues, as well as knowledge from other companies and industries.

[FY2023 Executive Officers Liaison Meeting Lecture Topics]

-

①Owls Consulting Group, Inc.

Principal Ayumi Yamori

Theme: Social trends related to business and human rights, leading examples, etc. -

②Machiko Miyai, Outside Director

Theme: The Morinaga Group sustainable management -

③Takuya Shimamura, Director Chairman, AGC Inc.

Theme: Ambidextrous management: Working toward organizational cultural change

~Conditions for a leader to shine a light in people's hearts~ -

④Yoshihiko Hatanaka, Outside Director

Theme: Responsibility and thoughts for the next generation

Nomination and Remuneration Advisory Committee

We have established a voluntary advisory committee on nomination and remuneration to supplement the functions of the Board of Directors and to increase the fairness and transparency of management.

The Nomination and Remuneration Advisory Committee deliberates on matters related to improving the effectiveness of the Board of Directors, including the election and dismissal of senior management, the nomination of candidates for director, and the remuneration system and level of remuneration for directors. The Committee also deliberates on the appointment of former representative directors and presidents to the positions of advisors or executive advisors as well as other relevant factors as their treatment, and submits recommendations and advice to the Board of Directors.

The Nomination and Remuneration Advisory Committee is composed of seven members, the majority of whom are independent outside directors. The chairperson is selected from the independent outside directors.

Remuneration and Other Compensation for Executives

-

Policy regarding determination of remuneration and other compensation

-

①Basic policy

Our executive remuneration system establishes the following policies to realize the Group's corporate philosophy.- To contribute to the sustainable growth of the Group and the enhancement of its corporate value over the medium to long term

- To ensure that executives share a common sense of interest with shareholders and increase their awareness of shareholder-oriented management

- To be a highly performance-linked remuneration system for executives and serve as motivation to achieve management plans

- To improve the competitiveness of the Group and serve as a mechanism and standard that enables us to acquire and retain diverse and superior management personnel

-

②Remuneration mindset

Remuneration for executive directors consists of base remuneration, bonuses, and share-based compensation.

Compensation for outside directors and Audit and Supervisory Board members consists solely of base remuneration.

-

<Base remuneration>

- Regular monthly remuneration*

- Within the scope of executive remuneration, a fixed amount is paid according to the roles and responsibilities of directors.

- Executive directors are required to purchase shares of the Company through the Executive Stock Ownership Plan for a fixed amount of base remuneration.

-

<Bonuses>

- Determined within the scope of the payment rate (0% to 100%) linked to the achievement of targets for operating income, ROIC, Company performance, and other financial indicators as well as ESG indicators, if certain criteria are met regarding ROE and dividends.

-

<Share-based compensation>

- To further increase motivation and contribute to improving medium-to long-term performance and increasing corporate value

- Points are awarded every year according to the position, and shares equivalent to accumulated points during the term of service are issued at the time of retirement

-

-

-

Determination Process for Executive Remuneration and Other Compensation

-

We have established the Nomination and Remuneration Advisory Committee as an advisory body to the Board of Directors in order to achieve the purposes of the executive compensation system.

This committee deliberates on the structure and level of remuneration for directors, verifies the appropriateness of individual remuneration, and uses objective and transparent procedures. Through the above procedures, the Board of Directors has determined that the content of remuneration, etc. for each individual director for the fiscal year in question is in line with the decision-making policy.

<Overview of the Nomination and Remuneration Advisory Committee and the Methodology of Determining Remuneration, etc.>-

●The Committee shall be convened by the chairperson (outside director).

-

●The agenda of the Committee shall be submitted to the Committee by the Secretariat, which shall be submitted to the Chairperson.

-

●The results of deliberations shall be reported to the Board of Directors by the chairperson.

-

●The Board of Directors shall respect the recommendations of the Committee and make the final decision on the policy for determining the remuneration of directors. Committee members and directors must make these decisions from the perspective of whether or not they contribute to the corporate value of the Company and the common interests of shareholders, and must not aim to benefit the personal interests of self or third parties, including the management of the Company.

-

●The Board of Directors decides the specific amount, timing, and method of payment of individual director remuneration based on the recommendations of the Nomination and Remuneration Advisory Committee from the viewpoint of further strengthening the Board of Directors' supervisory functions and ensuring further objectivity and transparency.

-

-

Officer Remuneration in FY2023

| Basic remuneration | Bonus | Share-based compensation | Total | |||||

|---|---|---|---|---|---|---|---|---|

| Number of eligible officers (persons) |

Amount | Number of eligible officers (persons) |

Amount | Number of eligible officers (persons) |

Amount | Number of eligible officers (persons) |

Amount | |

| Directors | 13 | 426 | 7 | 320 | 7 | 83 | 13 | 829 |

| Of which Outside Directors | 6 | 72 | - | - | - | - | 6 | 72 |

| Audit and Supervisory Board members | 8 | 79 | - | - | - | - | 8 | 79 |

| Of which outside Audit and Supervisory Board members | 5 | 36 | - | - | - | - | 5 | 36 |

-

Note

-

1.The aforementioned includes one Director and one Audit & Supervisory Board member who retired at the conclusion of the 101th General Meeting of Shareholders held on June 20, 2023.

-

2.The amount paid to officers does not include the portion of employee’s salary (including bonus) amounting to 46 million yen for Directors who concurrently serve as employees.

-

Notice of Convocation of the Annual General Meeting of Shareholders see here

Director Company Stock Ownership Guidelines

For directors (excluding outside directors) and executive officers, we have introduced a share-based compensation plan in order to further motivate them to contribute to improving medium-to long-term performance and increasing corporate value. In addition, we have established the "Stock Ownership Guidelines" for those who hold more than a certain number of shares.

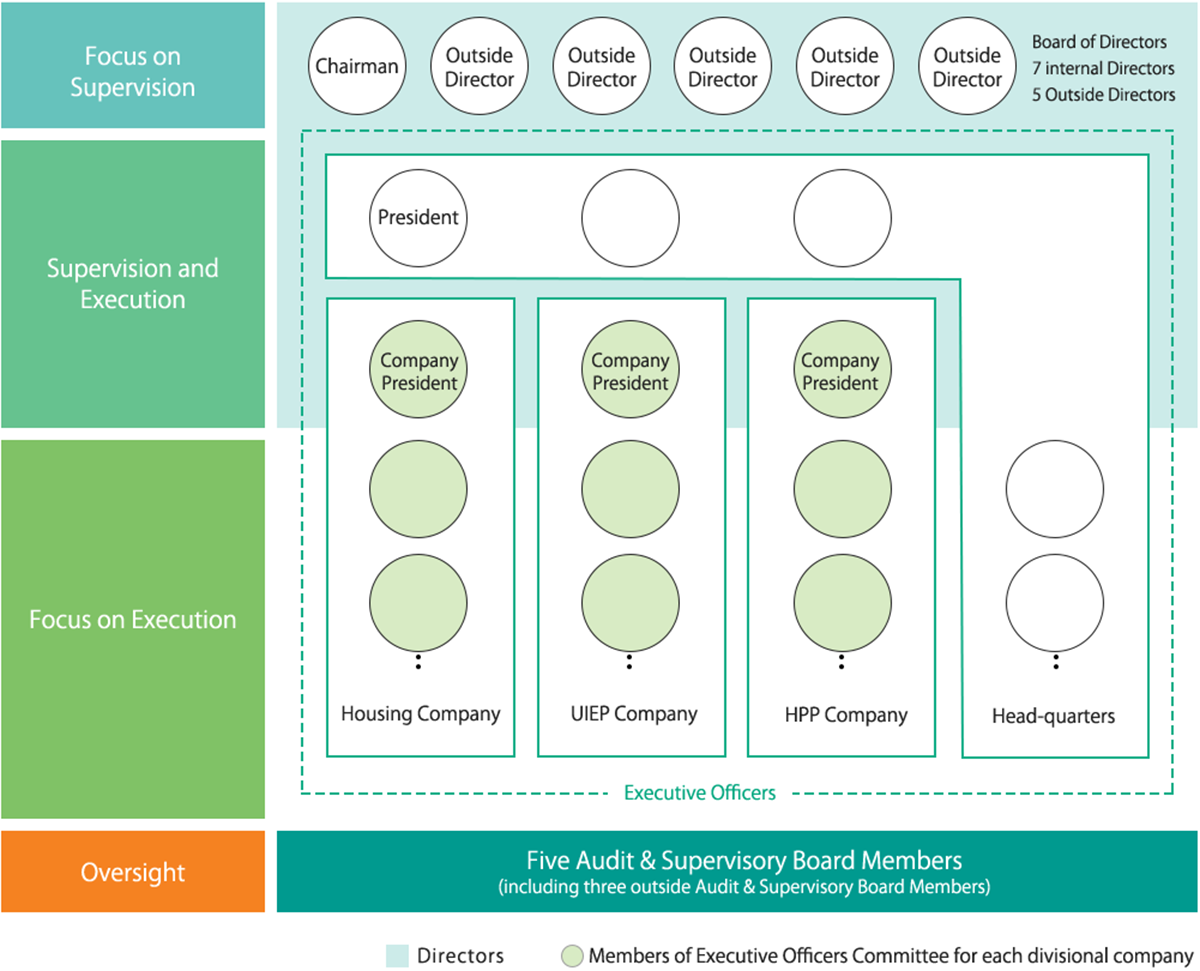

Executive Officer System and Executive Committee

We have established a management system based on the Divisional Company Organization System to maximize corporate value. Together with assigning operating officers specializing in business execution to each divisional company, the Executive Committee has been established to serve as the top decision-making body in each divisional company. As such, a broad range of authority has been transferred from the Board of Directors to the Executive Committee. Executive officers are appointed by a resolution of the Board of Directors for a term of one year.

Through the transfer of authority to divisional companies, the Board of Directors is responsible for determining the basic management policies of SEKISUI CHEMICAL Group and for making sophisticated management decisions and overseeing business execution in an effort to continuously increase corporate value.

Management System

- 16-08

Auditing System

Approach to the Appointment of Audit and Supervisory Board Members

The Audit and Supervisory Board has a total of five Audit and Supervisory Board members: Two full-time in-house Audit and Supervisory Board members and three part-time outside Audit and Supervisory Board members. As far as the composition of the Audit and Supervisory Board is concerned, one or more members will have knowledge and expertise in corporate finance and accounting, one or more will have knowledge and expertise in legal systems, and one or more will have knowledge and expertise in manufacturing and CS & Quality, which are extremely important for manufacturers.

Officers with experience as Head of Legal Department and plant managers have been appointed as in-house Audit and Supervisory Board members in fiscal 2024.

Three outside Audit and Supervisory Board members are appointed: A certified public accountant with experience working at an auditing firm, a lawyer with extensive experience in corporate legal affairs, and a university professor specializing in quality control.

Internal Control System

In May 2006, the Board of Directors adopted a basic policy for establishing an internal control system to ensure the appropriateness of its business.

Specifically, under the "Corporate Activity Guidelines" based on the Group corporate philosophy, we closely coordinate the direction, order, and communication of SEKISUI CHEMICAL Group (the Company and its subsidiaries). At the same time, we provide guidance, advice, and evaluation to Group companies to ensure the appropriateness of the Group's overall operations.

Internal Control System

In order to appropriately develop and operate the internal control system for the Company and Group companies, our Corporate Audit Department conducted operational and accounting audits of the Company and Group companies based on the annual audit plan, and audited whether business execution was conducted appropriately and efficiently. The results of internal audits are regularly reported at management meetings. In addition, the director in charge or full-time Audit and Supervisory Board member reports to the Board of Directors, as necessary, on the status of improvements made to matters pointed out by internal audits.

Execution of Duties by Directors

In order to ensure that Directors carry out their duties efficiently, the Board of Directors met 17 times in fiscal 2023. In addition, discussions of important matters related to our management policies and strategies were carried out at meetings of the Policy Committee, which is made up of inside Director members charged with the responsibility of carrying out the executive function. Policy decisions were made by the Board of Directions following these discussions.

Execution of Duties by Audit and Supervisory Board Members

Audit and Supervisory Board members attended not only the Board of Directors meetings but also other important meetings, carrying out confirmation of the maintenance and operating conditions of the internal control system through operations such as investigation of related departments, including at Group companies, and confirmation of approval documents for major projects. In addition to personally visiting various sites for audits, they also receive reports from the Internal Auditing Department and each headquarters department that has jurisdiction over internal control. The Audit and Supervisory Board met 13 times in fiscal 2023 for the purpose of sharing the information from these reports. Audit and Supervisory Board members regularly exchanged opinions with accounting auditors, cooperating closely to improve the effectiveness of auditing efforts. Liaison meetings were held with related corporate auditors to improve coordination with auditors and enhance the quality of auditing. In addition, regular meetings were held with the Representative Director, and Audit and Supervisory Board members also exchanged opinions with Outside Directors.

Group Company Business Management

Through rules such as our domestic and overseas affiliate company handling policy and affiliate company decision-making guidelines, we have constructed a framework for getting approval and reports from Group subsidiaries to the Company. In addition, our Corporate Audit Department implements internal auditing and results of audits by Audit and Supervisory Board members of our Group companies are collected at Audit and Supervisory Board meetings.