Maintaining Active and Stable Returns to Shareholders

Under the medium-term management plan "Drive 2.0" (FY2023-2025), SEKISUI CHEMICAL Group returns profits to its shareholders more aggressively than ever before. The Company seeks to secure a dividend-on-equity (DOE) ratio of 3% or higher while targeting a dividend payout ratio of 40% or higher on a consolidated basis, as a part of efforts to implement stable dividend measures in line with its performance. In addition, SEKISUI CHEMICAL Group has set a target of 50% or higher for its total return ratio, which includes the buyback of shares, so long as its D/E ratio is less than 0.5. Implement additional returns as appropriate, taking into account the investment progress under the medium-term management plan, cash position, and stock price. Moreover, the Company plans to retire treasury stock to no more than 5% of the total number of shares outstanding.

Cash dividends per share

FY2024 ¥79

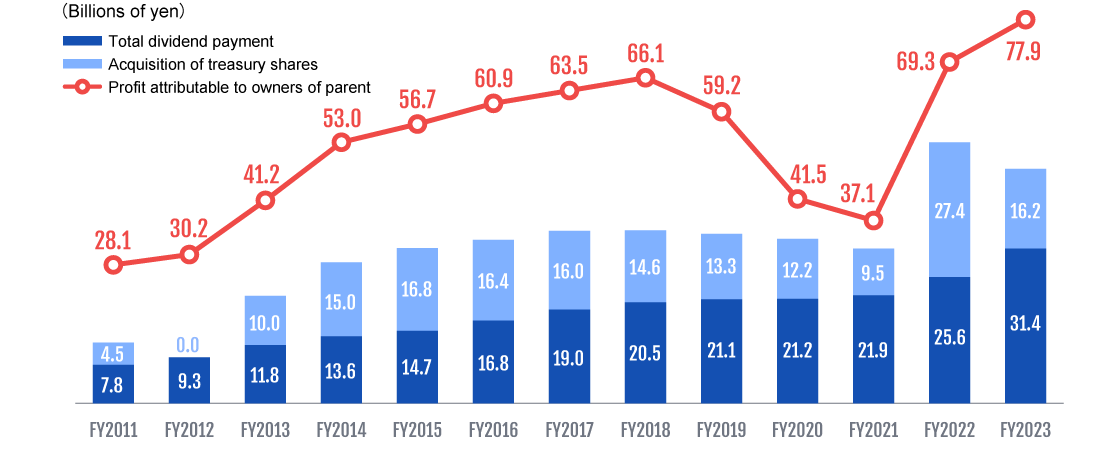

Return to Shareholders Track Record

| Fiscal Year | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Profit attributable to owners of the parent per share (yen) | 58.5 | 80.1 | 104.7 | 115.1 | 126.1 | 133.8 | 141.7 | 128.8 | 91.9 | 83.2 | 159.2 | 183.5 | 196.0 |

| Dividend per share (yen) | 18 | 23 | 27 | 30 | 35 | 40 | 44 | 46 | 47 | 49 | 59 | 74 | 79 |

| Payout ratio | 30.8% | 28.7% | 25.8% | 26.1% | 27.7% | 29.9% | 31.0% | 35.7% | 51.1% | 58.9% | 37.0% | 40.3% | 40.4% |

| Acquisition of treasury shares (billions of yen) | 0 | 10.0 | 15.0 | 16.8 | 16.4 | 16.0 | 14.6 | 13.3 | 12.2 | 9.5 | 27.4 | 16.2 | 8.9 |

| Total return ratio* | 30.8% | 52.9% | 54.0% | 55.5% | 54.5% | 55.1% | 53.0% | 58.1% | 80.4% | 84.6% | 76.5% | 61.0% | 51.2% |

| DOE* | 2.4% | 2.7% | 2.8% | 2.8% | 3.1% | 3.3% | 3.4% | 3.5% | 3.3% | 3.3% | 3.7% | 4.2% | 4.1% |

| Retirement of treasury shares (thousand of shares) | 7,000 | ‐ | 12,000 | 10,000 | ‐ | 10,000 | 8,000 | 8,000 | 8,000 | 5,000 | 15,000 | 8,000 | 4,000 |

*Total return ratio=(Amount of treasury shares acquired + Total dividends)/Profit attributable to owners of parent

*DOE=Total dividend payment (full year)/Average equity