Corporate Governance

Basic Philosophy and Framework for Corporate Governance

SEKISUI CHEMICAL Group (the Group) has put in place a basic philosophy regarding corporate governance that lays out efforts for securing sustainable growth and increasing corporate value over the medium and long terms. To help achieve these goals, we are increasing the transparency and fairness of our management and pursuing swift decision- making and will do so while continuing to meet-through the creation of value for society that is part of our Corporate Philosophy-the needs of the five types of stakeholders the Group emphasizes: customers, shareholders, employees, business partners, and local communities and the environment.

SEKISUI Corporate Governance Principles

The Company has established and disclosed the Sekisui Corporate Governance Principles for the purpose of further evolving its corporate governance initiatives and communicating our corporate governance approach and initiatives to our stakeholders.

In addition to the above Principles, the status of the Company’s initiatives and its approach with respect to the Corporate Governance Code, consisting of the General Principles, Principles, and Supplementary Principles, are summarized and disclosed in the form of the Initiatives to Each of Principles of the Corporate Governance Code.

- Corporate Governance Report (June 23, 2025)(pdf:1.2MB)

- SEKISUI Corporate Governance Principles (April 1, 2024)(pdf:858KB)

- Initiatives to Each of Principles of the Corporate Governance Code (June 21, 2024)(pdf:841KB)

- Action to Implement Management that is Conscious of Capital Cost and Stock Price (June 20, 2024)(pdf:727KB)

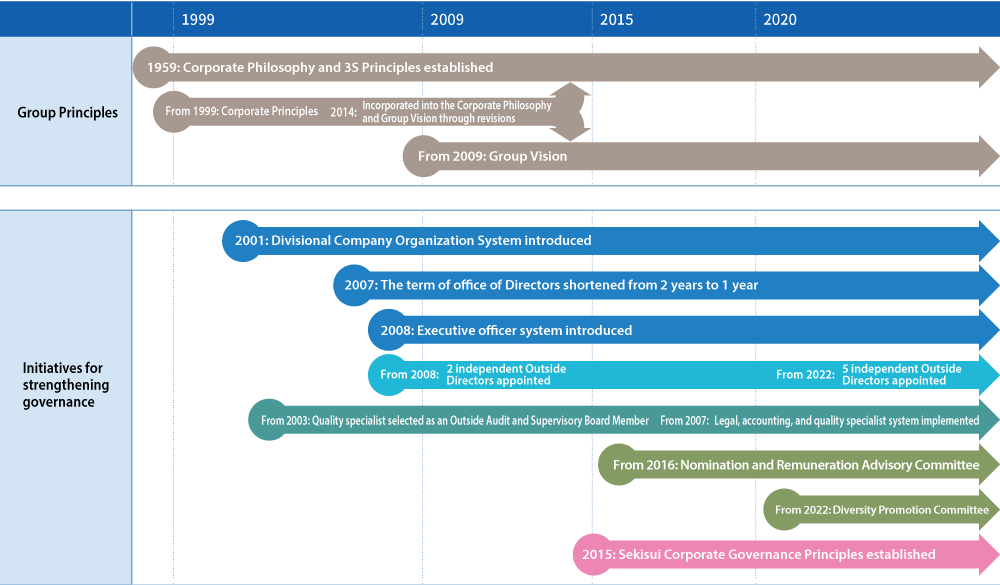

Corporate Governance Initiatives

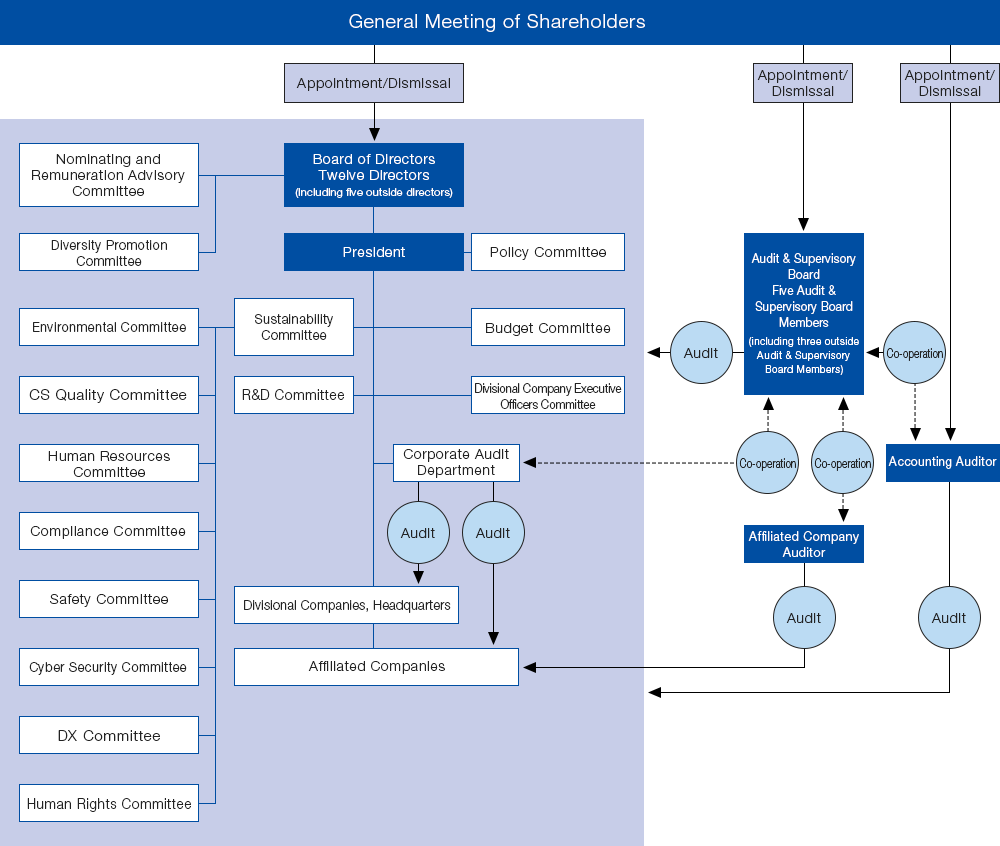

Organizational Structure

As an organizational structure under the Companies Act, the Company has chosen to be a company with Audit and Supervisory Board. Under the Divisional Company Organization System, the Company has adopted the Executive Officer System in order to clearly distinguish the business execution function from the decision-making function in management.

| Organizational Structure | A company with an Audit and Supervisory Board |

|---|---|

| Total number of directors | 12 (In-house: 7; Outside: 5) |

| Ratio of outside (independent) directors | 41.7% |

| Director's term of office | 1 year |

| Executive officer system introduced | Yes |

| Organization to assist the president in making decision | Policy Committee |

| Voluntary advisory board to the Board of Directors | Nomination and Remuneration Advisory Committee established |

Initiatives Taken to Enhance Corporate Governance

Corporate Governance System Chart (As of April 1, 2025)

Board of Directors

Roles and Responsibilities of the Board of Directors

The Board of Directors is positioned as the body responsible for decision-making concerning the Company's fundamental policies and upper-level management issues as well as for supervising the execution of business.

In addition to the Company’s Chairman, who is a non-executive director and serves as its chair, the Board of Directors has in place a highly effective supervisory system for Directors by appointing sufficiently experienced Outside Directors to ensure transparency in management and fairness in business decisions and operations.

Composition of the Board of Directors

The number of Directors shall not exceed 15, and two or more of them shall be Outside Directors.

The Board of Directors of the Company shall consist of directors who are of excellent character, have insight, and high moral standards in addition to knowledge, experience, and competence. In addition, Audit and Supervisory Board Members, including outside Audit and Supervisory Board members, shall attend the meetings of the Board of Directors. With regard to the Audit and Supervisory Board, one or more members will have knowledge and expertise in corporate finance and accounting, and one or more will have knowledge and expertise in legal systems.

Following the change in the Company’s president in March 2020, the Board of Directors is chaired by the Chairman, a non-executive director.

The Company ensures diversity among board members and keeps the number of Directors at an optimal level for appropriate decision-making that is commensurate with the business domain and size. The presidents of the divisional companies, who are the top management of each business and senior corporate officers with significant experience and strong expertise, are appointed as inside Directors. Together with the independent Outside Directors, who have broad knowledge and experience, and Audit and Supervisory Board Members with strong expertise, the presidents of the divisional companies effectively perform the roles and responsibilities of the Board of Directors and maintain a balance with respect to diversity, optimal size, and capabilities.

| Name | Position at the Company | Number of Years (At the closing of the Annual General Meeting of Shareholders ) |

Number of Years Attendance of the Board of Directors Meetings of the Company (The business term under review) |

Number of Attendance of Audit and Supervisory Board Meetings of the Company (The business term under review) |

Number of Attendance of Nomination and Remuneration Advisory Committee of the Company (The business term under review) |

Number of Attendance of the Diversity Promotion Committee of the Company (The business term under review) |

|---|---|---|---|---|---|---|

| Teiji Koge | Chairman of the Board | 20 years | 100% (18 out of 18) |

- | 100% (6 out of 6) |

100% (3 out of 3) |

| Keita Kato | President and Representative Director Chief Executive Officer | 11 years | 100% (18 out of 18) |

- | 100% (6 out of 6) |

100% (3 out of 3) |

| Ikusuke Shimizu | Representative Director Senior Managing Executive Officer | 6 years | 100% (18 out of 18) |

- | - | 100% (1 out of 1) |

| Yoshiyuki Hirai | Director Senior Managing Executive Officer | 10 years | 100% (18 out of 18) |

- | - | - |

| Masahide Yoshida | Director Senior Managing Executive Officer | 1 year | 100% (14 out of 14) |

- | - | - |

| Akira Asano | Director Managing Executive Officer | - | - | - | - | - |

| Kazuya Murakami | Director Executive Officer | 4 years | 100% (18 out of 18) |

- | - | 100% (3 out of 3) |

| Hiroshi Oeda | Independent Outside Director | 7 years | 100% (18 out of 18) |

- | 100% (6 out of 6) |

100% (3 out of 3) |

| Haruko Nozaki | Independent Outside Director | 3 years | 100% (18 out of 18) |

- | 100% (6 out of 6) |

100% (3 out of 3) |

| Miharu Koezuka | Independent Outside Director | 3 years | 100% (18 out of 18) |

- | 100% (6 out of 6) |

100% (3 out of 3) |

| Machiko Miyai | Independent Outside Director | 3 years | 100% (18 out of 18) |

- | 100% (6 out of 6) |

100% (3 out of 3) |

| Yoshihiko Hatanaka | Independent Outside Director | 2 years | 94% (17 out of 18) |

- | 100% (6 out of 6) |

67% (2 out of 3) |

| Tomoyasu Izugami | Fulltime Audit and Supervisory Board Member | 2 years | 100% (18 out of 18) |

100% (17 out of 17) |

- | - |

| Michio Sakai | Fulltime Audit and Supervisory Board Member | - | - | - | - | - |

| Yoshikazu Minomo | Independent Outside Audit and Supervisory Board Member | 3 years | 100% (18 out of 18) |

100% (17 out of 17) |

- | - |

| Wakyu Shinmen | Independent Outside Audit and Supervisory Board Member | 2 years | 94% (17 out of 18) |

100% (17 out of 17) |

- | - |

| Kenji Tanaka | Independent Outside Audit and Supervisory Board Member | 2 years | 100% (18 out of 18) |

100% (17 out of 17) |

- | - |

| Name | Directors' and Audit and Supervisory Board Members' Outstanding Expertise, Experience and Capabilities | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Management | Core Function of Manufacturing Business | Preparations for Long-term Growth | Strengthening the Management Base | |||||||

| Corporate Management / Management Strategy | Manufactu-ring / Safety / Quality | Marketing / Sales | Environment | Innovation (Research & Development / New Business Development / Alliance) | Global Business | DX (Digital Transform-ation) |

Legal Affairs / Compliance | Financial Affairs / Accounting | Human Resources / Diversity/ Human Rights | |

| Teiji Koge | ● | ● | ● | ● | ||||||

| Keita Kato | ● | ● | ● | ● | ● | ● | ● | |||

| Ikusuke Shimizu | ● | ● | ● | ● | ● | ● | ||||

| Yoshiyuki Hirai | ● | ● | ● | ● | ● | ● | ||||

| Masahide Yoshida | ● | ● | ||||||||

| Akira Asano | ● | ● | ● | |||||||

| Kazuya Murakami | ● | ● | ||||||||

| Hiroshi Oeda | ● | ● | ● | ● | ||||||

| Haruko Nozaki | ● | ● | ||||||||

| Miharu Koezuka | ● | ● | ● | ● | ||||||

| Machiko Miyai | ● | ● | ● | ● | ● | |||||

| Yoshihiko Hatanaka | ● | ● | ● | ● | ||||||

| Tomoyasu Izugami | ● | ● | ● | |||||||

| Michio Sakai | ● | ● | ● | ● | ||||||

| Yoshikazu Minomo | ● | ● | ||||||||

| Wakyu Shinmen | ● | |||||||||

| Kenji Tanaka | ● | ● | ● | |||||||

About the Age-group Composition of Corporate Officers

| Under 30 | 30~39 | 40~49 | 50~59 | 60 or older | |

|---|---|---|---|---|---|

| Number of Officers by Age | 0 | 0 | 0 | 2 | 10 |

Outside Directors

The Company appoints to the Board Outside Directors with verified independence from the Company who contribute to the enhancement of corporate value by providing oversight and advice based on their extensive administrative experience and specialized knowledge gained in backgrounds different to those of the Company. Based on their diverse and objective perspectives, the Outside Directors provide counsel especially on priority management issues, such as global development strategy, business model revisions, and the strengthening of ESG management.

- Hiroshi Oeda, Outside Director

- Mr. Oeda serves as Corporate Special Advisor at Nisshin Seifun Group Inc. As Mr. Oeda has been a management executive of the largest milling company in Japan, the Company expects him to provide advice with respect to the business management of the Company and supervise business execution appropriately by leveraging his abundant experience and skill regarding global corporate management, business strategies, and M&A activities fostered through his positions. Therefore, the Company has judged that he would be able to contribute to enhancing the corporate value of SEKISUI CHEMICAL Group and thus appointed him as a director.

- Haruko Nozaki, Outside Director

- Ms. Haruko Nozaki has experience in personnel affairs and education at HORIBA, Ltd. and deep insight on promotion of diversity, development of the next generation, etc., and currently serves as Executive Vice-President of Kyoto University and External Director of West Japan Railway Company. The Company expects she will provide pertinent advice at meetings of the Board of Directors regarding medium- to long-term issues based on her insight on human resources, and judging that she will contribute in this way to improving the corporate value of the Group, and thus appointed her as a director.

- Miharu Koezuka, Outside Director

- Ms. Miharu Koezuka held positions of Representative Director and General Manager of Planning Headquarters and General Manager of Sales Headquarters of Takashimaya Company, Limited, and was involved in management of the said company for many years as a member of the management team. Ms. Koezuka currently serves as Outside Director of Japan Post Holdings Co., Ltd., and Nankai Electric Railway Co., Ltd. The Company expects that Ms. Koezuka will utilize her experience in diverse industries in Board of Directors meetings to provide multifaceted and pertinent advice, and judging that she will contribute in this way to improving the corporate value of the Group, and thus appointed her as a director.

- Machiko Miyai, Outside Director

- Ms. Machiko Miyai held positions of executives at Panasonic Corporation and then has served as Director and the head of the marketing department at MORINAGA & CO., LTD. As such, Ms. Miyai has broad job experience mainly in consumer-conscious duties in industries that are different from that of the Company. The Company expects that Ms. Miyai will utilize her abundant experience and wide-ranging knowledge in Board of Directors meetings to provide pertinent advice, and judging that she will contribute in this way to improving the corporate value of the Group, and thus appointed her as a director.

- Yoshihiko Hatanaka, Outside Director

- Mr. Yoshihiko Hatanaka has served as an executive at Astellas Pharma Inc., and in addition to his wide-ranging knowledge of global corporate management cultivated through his rich experience in Europe, the United States, and other overseas countries, he also has extensive experience in corporate integration, etc., based on his experience as a corporate planning officer. Based on these experiences and achievements, the Company expects that he will provide appropriate advice to the Group's management and contribute to the enhancement of corporate value and thus appointed him as a director.

Assessment Relating to the Board's Effectiveness

We evaluate the effectiveness of the Board of Directors every year.

Through questionnaires targeting directors and auditors, we confirm that sufficient deliberation time is secured at Board of Directors meetings, and that directors and auditors, including outside directors, actively offer opinions and suggestions.

In addition, with the aim of further improving effectiveness, we are making appropriate revisions, such as adding important management topics, based on the responses obtained from the questionnaire.

The main Board of Directors meeting topics for FY2023 are growth strategies (R&D, large-scale new businesses, large-scale capital investment, etc.) and basic strategies (sustainability, digital transformation, safety, compliance, CS and quality, etc.).

Support for and Collaboration with Directors and Audit and Supervisory Board Members

To enable the Outside Directors to enhance deliberations at Board of Directors' meetings, the Company continuously provides opportunities for them to deepen their understanding of the Group's businesses. This is done, for example, by the prior distribution of materials for Board of Directors' meetings and explanations given beforehand by the executive officer in charge of the secretariat, orientation visits at the time Outside Directors are appointed, and inspections of business sites several times a year. To further enhance the effectiveness of management supervision by Outside Directors, the Company is making improvements to the deliberations that take place at the Nomination and Remuneration Advisory Committee, where the majority of the members are Outside Directors, and facilitating their dialog with Audit and Supervisory Board Members and corporate auditors. From the point of view of succession planning, the Company is strengthening contacts between current management and next-generation management candidates, for example by having Outside Directors give lectures at Executive Officers Liaison Meetings that are held on a quarterly basis and providing opportunities for Directors, Audit and Supervisory Board Members and Executive Officers to meet when the new management system is inaugurated following the Annual General Meeting of Shareholders.

- Business Site Visits

-

In fiscal 2024, we conducted inspections of each company's production facilities (Housing Company: SEKISUI Heim Industry Co.,Ltd., Environment & Infrastructure Company: Chiba Solution Center and Chiba Sekisui Industry Co., Ltd., High Performance Plastics Company: SEKISUI Techno Molding Co., Ltd. Aichi Plant and SEKISUI Nano Coat Technology Co., Ltd.

Comprehension of external trends related to economic, environmental, and social issues

At the quarterly Executive Officers Liaison Meetings, the sharing of earnings announcements is combined with invited speakers from outside the company, so that stakeholders obtain the latest information on economic, environmental and social trends that are directly linked to management issues.

Topic of the FY2024 Lecture by the Executive Officer Contact Committee

- Tetsuya Nagasawa

Attorney at Law, Oebashi Law Office

Topics: The significance of compliance for fair trade - Ken Kusunoki

Hitotsubashi Business School of Professor

Topic: Competitive strategy as a story - Toshiaki Higashihara

Hitachi, Ltd. of Chairman and CEO

Topic: Thinking about Hitachi's management reforms:

Japan's future and future corporate management - Kazuya Soejima

Newton Consulting Co., Ltd. of President and CEO

Topic: An eye-opener about risk management:

What is the key to making risk management activities work for you?

Nominating and Remuneration Advisory Committee

The Company has established an optional advisory committee concerning nomination and remuneration to further enhance the fairness and transparency of management.

The Nomination and Remuneration Advisory Committee deliberates on matters related to enhancing the effectiveness of the Board of Directors, including the nomination and non-reappointment of senior executives, including representative directors, the nomination of candidates for director, and the system of remuneration and levels of remuneration for directors. The Committee also discusses the commissioning of and dealings with advisors or executive advisors, including former representative directors and presidents, and submits recommendations and advice to the Board of Directors. The Nomination and Remuneration Advisory Committee comprises seven members, the majority of whom are independent outside directors. The Chairperson is elected from the independent outside directors.

Remuneration and Other Compensation for Officers

- 1. Policy regarding determination of remuneration and other compensation

-

- The remuneration system policy for officers of the Company is defined as follows in keeping with the corporate philosophy of the Group.

-

- The policy should contribute to sustainable growth and medium- to long-term improvement of corporate value for the Group

- Officers of the Company should share value with shareholders and increase their awareness of shareholder-focused management

- The remuneration policy should be highly connected to business performance, providing motivation for officers of the Company to achieve management plan goals

- The policy should provide a framework and baseline which enables the Company to acquire and keep on staff a diverse variety of management talent in order to increase the competitiveness of the Group

- Remuneration and other compensation for executive directors of the Company is made up of basic remuneration, bonuses, and shared-based compensation. For Outside Directors and Audit & Supervisory Board Members, remuneration is made up of basic remuneration only.

-

- Basic remuneration is paid in a certain amount corresponding to each Director's roles and responsibilities within a limit on officers' remuneration. For executive directors, a portion of the basic remuneration is required to be used for the purpose of buying the Company's stock through the Officers Stock Ownership Plan.

- Bonus is paid if certain standard for ROE or dividend is met and is determined by reflecting a multiplier set by job function and a divisional company-specific multiplier (60 to 120%) linked to the achivement of targets for financial indicators (operating income, ROIC, etc.) and non-financial indicators (environment, human capital, etc.) on a base amount linked to the company-wide operating profit amount.

- Share-based compensation is medium- to long-term incentive plan and intended to further motivate officers to contribute to improving the Company's financial results and growing its corporate value in the medium- to long-term. This plan is designed so that Directors can enjoy the results of contribution to the improvement of corporate value over the medium- to long-term with the shares at the time of retirement, and is designed more closely linked to the shareholder value over the medium- to long-term.

- The remuneration of Directors is determined in accordance with their position and duties. The ratio of performance-linked remuneration is set so that the higher the position, the higher the ratio. The duties reflect the performance of the company in charge.

Basic remuneration and bonuses, which are monetary remuneration, will be paid regularly during the term of office, and share-based remuneration will be paid in a lump sum at the time of retirement.

- 2. Process of determining officers' remuneration

-

- The Company has the Nomination and Remuneration Advisory Committee as an advisory body to the Board of Directors, running the system through objective and transparent procedures with the Committee deliberating on the remuneration structure-levels for Directors and the reasonableness of individual payouts.

- < Outline of the Nomination and Remuneration Advisory Committee and how remuneration, etc. is determined >

- A meeting of the Nomination and Remuneration Advisory Committee is convened by the chairperson (Outside Director).

- A proposal to the meeting is put forward by committee members and the secretariat compiles them before submitting them to the chairperson.

- The result of deliberations by the meeting is reported to the Board of Directors by the chairperson.

- The decision policy for Directors' remuneration, the specific amounts of individual remunerations of Directors, the payment timing, and the payment methods are determined ultimately by the Board of Directors by adhering to the report. In determining the policy, members of the committee and Directors are required to do so from a perspective of whether it will help enhance the Company's corporate value and ultimately the common interest of shareholders, and they must not aim for their own individual interests or those of a third party such as the Company's management.

- In the process of determining the amount of remuneration for the 103th fiscal term, the Directors' remuneration level and the content of individual evaluation and remuneration of Directors were deliberated by the Nomination and Remuneration Advisory Committee in June 2024 and June 2025, and finally decided by the board of directors.

- For the indicators for performance-based remuneration, the Company has selected operating income, which is the business performance target of the Company; the business performance of the divisional companies, which reflects the business performance of the Group's unique divisional company system; ROE, an assessment criteria for the improvement of the Group's corporate value; ROIC; dividends, which provide incentive to return these management results to shareholders, and ESG indicators as these will enable the performance-based remuneration to function effectively as an incentive for the Directors of the Company to improve the Group's corporate value and achieve the management plan, as well as to ensure a high level of objectivity and transparency of the remuneration process. The amount of payment is determined to keep the balance with the above indicators by utilizing the executive remuneration data of outside research agencies and periodically making comparisons with companies similar in size and business performance to the Group.

Officer Remuneration in Fiscal 2024

| Basic remuneration | Bonus | Share-based compensation | Total | Number of eligible officers (persons) | |

|---|---|---|---|---|---|

| Directors (excluding outside directors) | 346 | 340 | 79 | 766 | 7 |

| Audit and Supervisory Board Members(excluding Outside Audit and Supervisory Board Members) | 44 | - | - | 44 | 3 |

| Outside Directors, and Audit and Supervisory Board Members | 108 | - | - | 108 | 8 |

The above includes one Director who resigned at the conclusion of the 102nd Annual General Meeting of Shareholders held on June 20, 2024.

The amount paid to officers does not include the portion of employee's salary (including bonus) amounting to 47 million yen for directors who concurrently serve as employees.

⇒Notice of Convocation of the Annual General Meeting of Shareholders

https://www.sekisui.co.jp/ir/document/invite/index.html

- Director Company Stock Ownership Guidelines

- In addition to having introduced, for Directors (excluding Outside Directors) and divisional company Executive Officers, a share-based compensation plan to further raise motivation to contribute to the improvement of mid- and long-term business performance and improve the Group's corporate value, the Company has established "Company Stock Ownership Guidelines" for those who are holding more than a certain number of shares.

Executive Officer System and Executive Committee

To maximize corporate value, the Company has built its management structure based on the Divisional Company Organization System. Together with assigning to each divisional company Executive Officers specializing in business execution, an Executive Committee has been established to serve as the top decision-making body in each divisional company. Executive Committee members, whose term of office is deemed to be for one year, are appointed by resolution of the Board of Directors.

By transferring authority to the divisional companies, the Board of Directors strives to achieve continual improvements in corporate value as an organization responsible for decisions on basic policies of SEKISUI CHEMICAL Group's management as well as high-level management decision-making and supervision of business execution.

Management system

Auditing System

Approach to Appointment of Audit and Supervisory Board Members

SEKISUI CHEMICAL Group maintains an Audit and Supervisory Board structure consisting of two full-time Corporate Audit and Supervisory Board Members and three part-time Outside Audit and Supervisory Board Members for a total of five Audit and Supervisory Board Members. As far as the composition of the Audit and Supervisory Board is concerned, one or more members will have knowledge and expertise in corporate finance and accounting, one or more will have knowledge and expertise in legal systems, and one or more will have knowledge and expertise in manufacturing and CS & quality, which are extremely important for manufacturers.

Officers with experience as Head of factory manager and internal audit department have been appointed as full-time Corporate Audit and Supervisory Board Members in fiscal 2025.

A certified public accountant with experience working for an auditing firm, a lawyer with extensive experience in corporate law, and a university professor specializing in quality control have been appointed as Outside Audit and Supervisory Board Members.

Internal Control System

In May 2006, the Board of Directors resolved to adopt a fundamental policy regarding the establishment of an internal control system for ensuring the appropriateness of the Group's business activities.

Based on the Corporate Activity Guidelines set forth in accordance with the Group corporate philosophy, the Company seeks to realize collaborative interaction concerning the supervision, directives, and communications of SEKISUI CHEMICAL Group (the Company and its subsidiaries), and SEKISUI CHEMICAL's duties include providing guidance and counsel, and undertaking evaluations of all SEKISUI CHEMICAL Group members to ensure that their business activities are being conducted in an appropriate manner.

Internal Control System Overview

In order to ensure the internal control system for the Company and Group companies is properly maintained and operated, our Corporate Audit Department carried out operation and accounting audits of the Company and Group companies based on a yearly auditing plan, investigating whether execution of operations is being performed appropriately and efficiently.

Compliance

The Board of Directors deliberates and decides on fundamental policies regarding compliance. Also, as the operational arm of the Sustainability Committee, we operate a Compliance Sub-committee with the Legal Department serving as the secretariat. In addition to divisional company and headquarters heads of administrative departments, the head of the Corporate Audit Department are also serving as members on this sub-committee, and this organization is reporting compliance activity results and matters for Compliance Advisory Board deliberation, as well as discussing future activity policy.

Execution of Duties by Directors

In order to ensure that Directors carry out their duties efficiently, the Board of Directors met 18 times in fiscal 2024. In addition, discussions of important matters related to our management policies and strategies were carried out at meetings of the Policy Committee, which is made up of inside (execution) Director members. Policy decisions were made by the Board of Directions following these discussions.

Execution of Duties by Audit and Supervisory Board Members

Audit and Supervisory Board Members attended not only the Board of Directors meetings but also other important meetings, carrying out confirmation of the maintenance and operating conditions of the internal control system through operations such as investigation of related departments, including at Group companies, and confirmation of approval documents for major projects. In addition to personally visiting various sites for audits, they also receive reports from the Internal Auditing Department and each headquarters department that has jurisdiction over internalcontrol. The Audit and Supervisory Board met 17 times in fiscal 2024 for the purpose of sharing the information from these reports. Audit and Supervisory Board Members regularly exchanged opinions with corporate auditors, cooperating closely to improve the effectiveness of auditing efforts. Liaison meetings were held with related corporate auditors to improve coordination with auditors and enhance the quality of auditing. In addition, regular meetings were held with the Representative Director, and Audit and Supervisory Board Members also exchanged opinions with Outside Directors.

Risk Management

The SEKISUI CHEMICAL Group has established a risk management structure for integrated management of measures to prevent risk events from occurring (risk management) and to respond when risk events occur (crisis management).

In our risk management activities, we comprehensively identify risks related to our corporate value based on the SEKISUI CHEMICAL Group Risk Management guidelines as the business environment becomes increasingly uncertain and complex. Each of these risks is quantitatively evaluated in terms of the likelihood of occurrence and impact, risks to be addressed on a priority basis are identified, and an ERM (enterprise risk management) system has been constructed for sharing and managing risks within the Group. Company-wide risks and specific risks identified for each organization are analyzed and evaluated. We then determine countermeasures for these risks and carry out repeated periodicreview and revision, which will be run through the PDCA management cycle every year.

In the event of a major incident, crisis management activities are carried out based on the SEKISUI CHEMICAL Group Crisis Management Guidelines. Crisis Manageme nt Liaison Meetings are held regularly with each specialized department of headquarters and divisional company representatives in attendance to ensure appropriate handling measures are implemented rapidly, and we also continually carry out cash studies and training sessions.

Furthermore, since fiscal 2021, the Group has been revising and developing documents for an emergency response plan (ERP) that places the protection of human life as the highest priority at all organizations as a Group- wide initiative. In addition, major business organizations have been advancing the establishment of a resource- based business continuity plan (BCP) as “All Hazard BCP” to respond when any crisis events occur.

Group Company Business Management

Through rules such as our domestic and overseas affiliate company handling regulations and decision-making authority standard requirements, we have constructed a framework for receiving decision-making and reports from Group companies to the Company. In addition, our Corporate Audit Department implements internal auditing and results of audits by Audit and Supervisory Board Members of our Group companies are collected at Audit and Supervisory Board meetings.

Engagement

In order to deepen mutual trust with all of our shareholders, we believe it is important not only to actively disclose information in a timely and appropriate manner, but also to enhance two-way communications with our shareholders. To steadily put this belief into practice throughout the Group, we set up the "Corporate Information Disclosure Regulations," which specify the content and system of disclosure, guided by the "Principle of Corporate Information Disclosure" and beefed up our internal information disclosure framework.

In SEKISUI CHEMICAL Group, the Investor Relations Group within the Business Strategy Department is working hard to strengthen engagement with our shareholders and investors, not only by disclosing financial statements in a timely and appropriate manner but also by actively reflecting our shareholders' voice in our management. For example, we hold quarterly briefings on financial results where our management explains these figures. Also, we pay heed to the voice of capital markets by holding one-on-one meetings with analysts and investors.

To ensure information is provided in a fair manner, the Group posts its financial statements and results briefings on the Company website in Japanese and English simultaneously and additionally provides audio recordings of the briefing and a transcript of the question and answer session.