Message from the President & CEO

Video Message

Massage from the Integrated Report

Reflecting on the Previous Fiscal Year

In spite of the unstable global situation and increasing uncertainties, SEKISUI CHEMICAL Group has reached its long-standing goal of achieving an operating profit of over 100 billion yen in FY2024. We twice revised our earnings outlook upward during the fiscal year, and the final result of 108.0 billion yen was very well received in the Europe IR meeting that we conducted from the end of May to June. I feel that this has further deepened the understanding of our Group’s strength and growth potential. I also believe that this record achievement is the result of our Long-term Vision, the formulation of a Medium-term Management Plan to realize that vision, and the steady promotion of the Plan.

In particular, during the period of the previous Medium-term Management Plan, Drive 2022, we faced deteriorating business performance due to the COVID-19 pandemic. However, we did not panic, but instead proceeded with structural reforms based on the assumption that the uncertain outlook would continue, and we have concurrently improved profitability by shifting to high-performance products and invested in the development of new businesses. The ongoing Medium-term Management Plan, Drive 2.0, is an important period that marks the turning point toward achieving our Long-term Vision. I feel that the results were achieved because we once again clarified what we wanted to be as a company, and all employees shared and grasped this with a clear understanding of what we were trying to accomplish.

I personally feel confident that the direction of our Long-term Vision and Medium-term Management Plan was the right one. KPIs that encourage employees to take on challenges have also steadily improved, and I believe that the results of the challenges we have embraced in the five years since the announcement of our Long-term Vision have led to these achievements.

The Value That SEKISUI CHEMICAL Group Provides to Society

Since its establishment, our Group has consistently worked to “solve problems that are at the root of life,” including social issues that affect the safety and health of people around the world, as well as global environmental changes, such as climate change and natural disasters, that have a serious impact on the survival of society. The ultimate outcome of the value creation process in our Group is “peace of mind for generations to come.” I believe that the Group’s social role is to ensure that we will not leave current social issues to future generations, so that people can continue to live with peace of mind, not only today, but also for the next generation and the future.

Although we have a diverse range of businesses, we have consistent strengths in Strategic Foresight, Processing, and Value Transformation. Our sources of value are our human capital, mainly our people who continue to embrace challenges, and our intellectual capital, including our technology platform and patents. We create value based on these strengths and work together with our stakeholders to make unique innovations.

The year 2025 marked the year of Expo 2025 in Osaka, Kansai, Japan, and the perovskite solar cells that we developed are being utilized at the venue, attracting great attention both in Japan and abroad. Our Group continues to take on the challenge of anticipating the needs of the market and social issues (Strategic Foresight), creating unique solutions by combining internal and external technologies (Processing), and transforming society by building new values and systems (Value Transformation).

At the same time, since we specialize in processing and do not own raw materials, we are working on development with a strong awareness that we cannot survive unless we create higher added value than our competitors. The concrete result of this effort is the continuous creation of “Products to Enhance Sustainability”. I believe that solving social issues means adding value to products, and, by increasing the number of Products to Enhance Sustainability, we will continue to strive to achieve a sustainable society with peace of mind for generations to come, while simultaneously improving corporate value.

Strategic Foresight by Matching Needs with Seeds

The Group’s greatest strength lies in Strategic Foresight. The phrase “Strategic Foresight” may suggest antennae fully extended to detect social issues, but other companies are equally aware of social issues. What is important is the kind of solutions that are provided to address those issues. Our Group is unique in that we place the highest priority on precisely matching the “needs of the world” (i.e., social issues) with the “strong seeds of our Group” (i.e., core technologies).

We have a number of competitive, world-class technologies, which we have inventoried and systematized into a technology platform. We combine these core technologies and, when necessary, integrate them with external technologies from other companies and universities, or develop them through open innovation. The Group also has significant strengths in intellectual property. We are focusing not only on adding value and improving profit margins, but also on efforts to leverage our intellectual property capabilities to sustain profits over the long term.

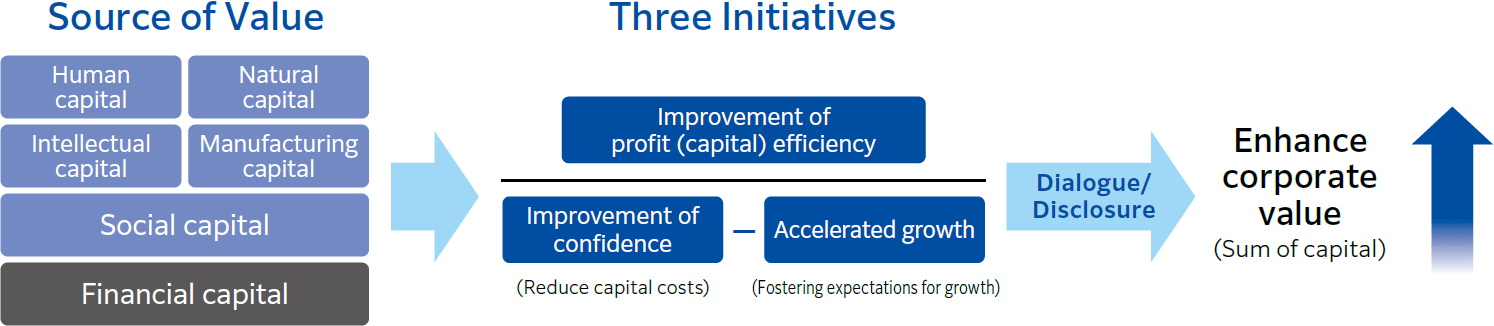

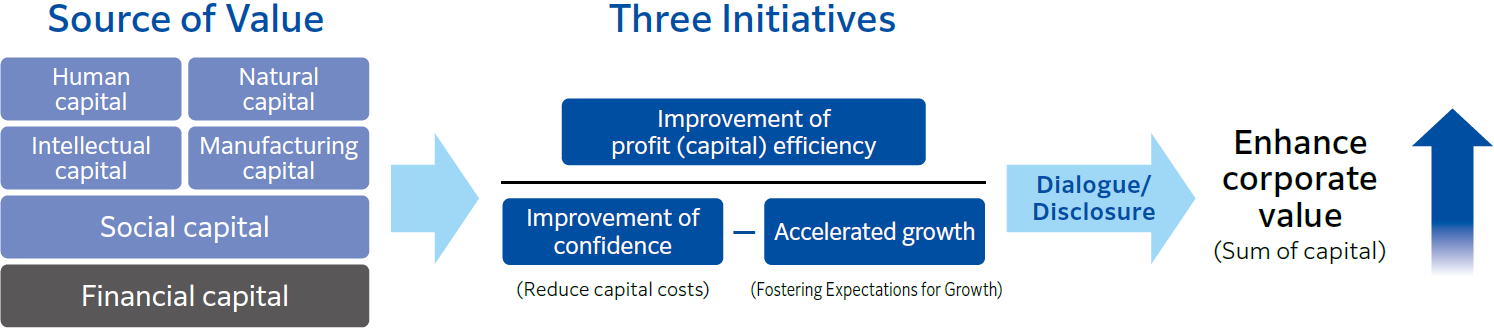

Current Status of Management That is Aware of Capital Costs and Stock Prices

We are promoting three initiatives to improve corporate value: improvement of capital efficiency, improvement of confidence, and accelerated growth. I believe that the most important thing for improvement of capital efficiency is to grow existing businesses. In order to foster expectations for growth, the “creation of new business areas” specified in the strategic area map is key, and we must set milestones for the commercialization of high-focus Innovation Areas in recent years, such as perovskite solar cells. With regard to reducing capital costs, I believe it is important to interpret this in a slightly broader sense, while also enhancing corporate governance. We will emphasize preventing the occurrence of incidents, such as serious misconduct that will damage corporate value if it occurs, while also evolving environmental management and human capital investment, and respecting human rights throughout the supply chain.

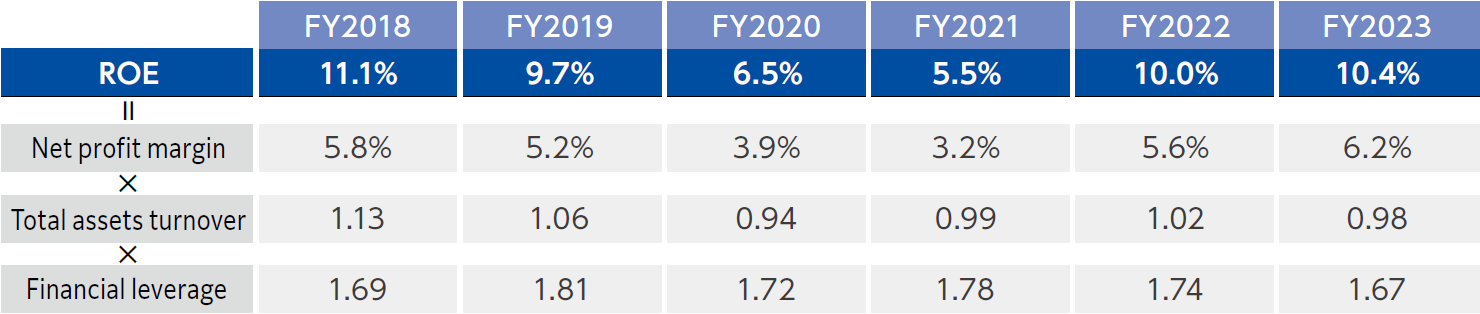

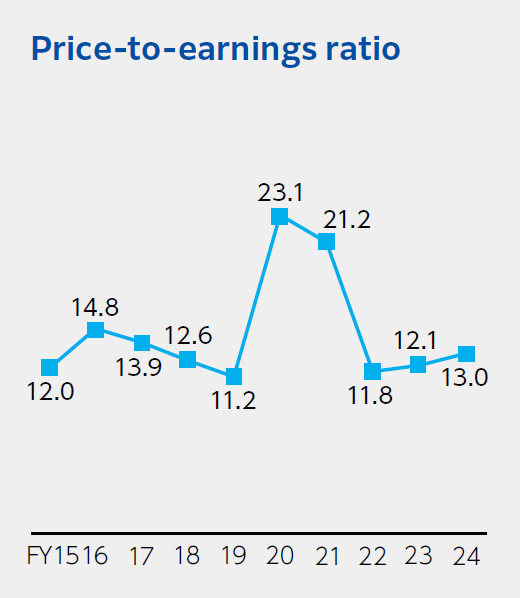

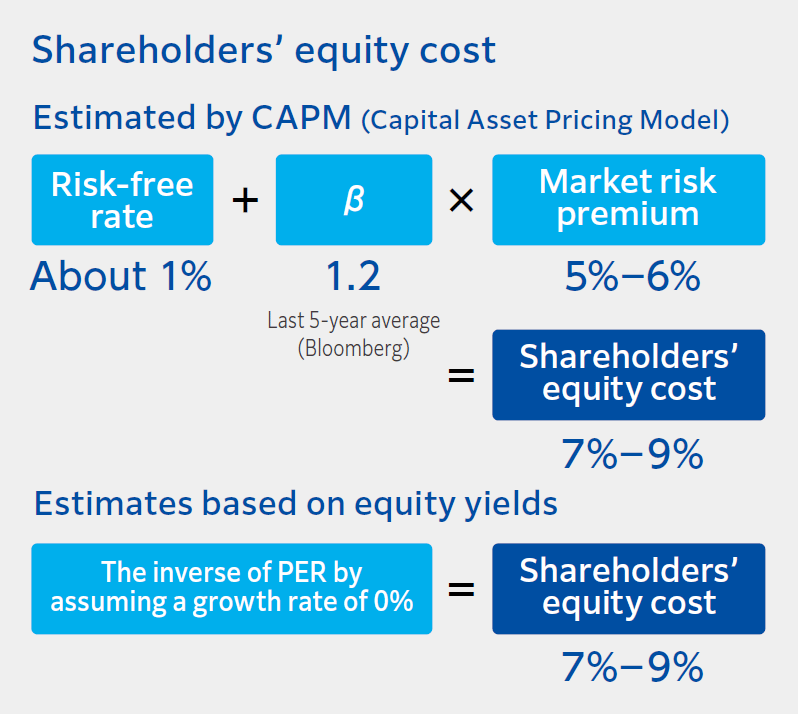

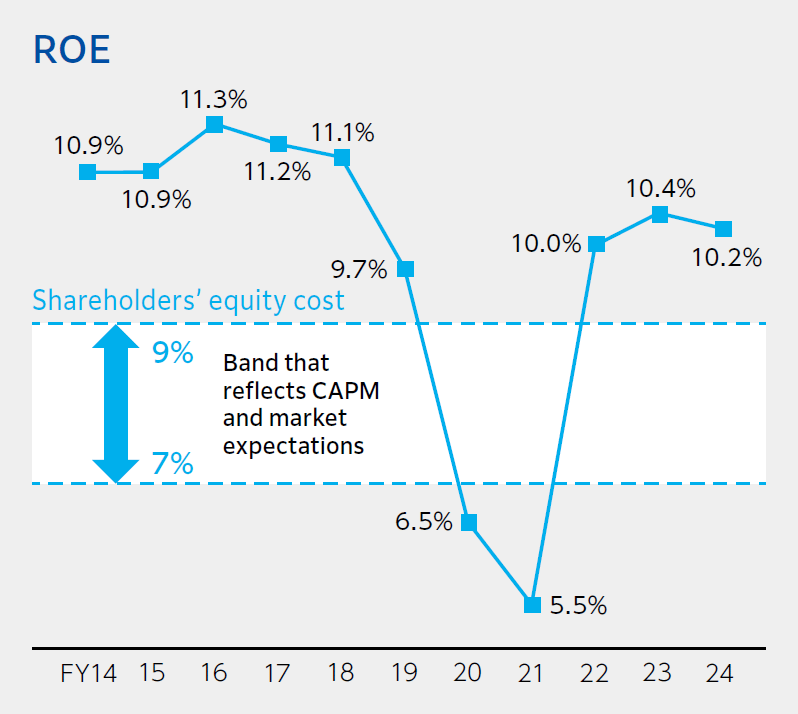

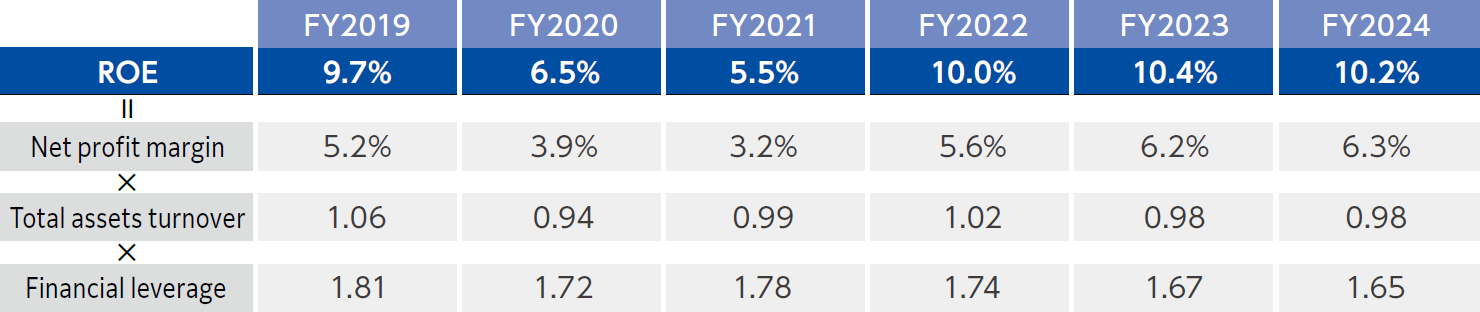

Our PBR has been stable at more than 1 over the past 10 years, and, with the exception of FY2020 and FY2021, which were affected by the COVID-19 pandemic, our PER has remained at a level of more than x10, while ROE has been stable above 10%. With regard to ROE, which is positioned as a particularly important management indicator, I am aware of the equity spread, which is the difference versus shareholders’ equity cost, and, except for during the COVID-19 pandemic, ROE has consistently exceeded our shareholders’ equity cost (7–9%). However, we will not be satisfied with the status quo, but, while remaining aware of capital efficiency, will aim to further improve profitability in order to achieve the 10% operating profit margin set forth in Vision 2030.

Breaking down ROE also reveals important challenges. Total assets turnover has remained below 1, but this is a temporary effect due to land purchases for town and community development, as well as for ready-built housing sales, and also due to growth investments in growth-driving businesses and new businesses, including perovskite solar cells. We will strive to translate these investments into results and improve our total assets turnover. In order to prevent assets from growing beyond necessity, investment projects are subject to preliminary screening and continuous effectiveness verification, and land and buildings are strictly monitored with turnover as a key KPI. Our financial leverage has maintained a level of efficiency and safety. Also, past trends show that the decline in net profit margin was directly related to the decline in ROE. I believe that in order to strengthen profitability in the future, accelerating growth and improving asset efficiency are important.

I hope that stakeholders will continue to focus on whether we can maintain a stable ROE of more than 10% over the medium to long term, and whether we are on a trend of further improvement.

Addressing Portfolio Management

The Group consists of three divisional companies: Housing, Urban Infrastructure & Environmental Products, and High Performance Plastics, as well as a Medical Business, each of which is steadily increasing its performance. Broadly speaking, High Performance Plastics is driving growth, while Housing and Urban Infrastructure & Environmental Products are generating stable earnings, and the Medical Business is a business with future growth potential.

Through portfolio management, we have developed strategies for all 33 businesses of the divisional companies and the Medical Business, classifying them into four quadrants from the perspective of “profitability, ROIC, and growth potential.” These four quadrants are: “Growth-driving,” “Growth potential,” “Revenue base,” and “Improvement.” Given the policy of allocating capital in a rational manner for sustainable growth, 60% or more of the total capital under the Medium-term Management Plan shall be allocated to the businesses in the two quadrants of “Growth-driving” and “Growth potential.” We expect to earn 90% or more of the increase in cash (EBITDA) out to 2025 from these two quadrants.

In order to support this growth, the “Revenue base” businesses will leverage existing strengths and buttress operations just as the name implies: by steadily creating a cash base. For businesses positioned as “Improvement” businesses, we will promote profitability transformation through bold structural reforms.

Firmly fulfilling the role of the businesses in each of these stages, we aim to increase corporate value by expanding the ROIC spread, as well as improving ROE. Our WACC is expected to be around 6–8%, which we use as a minimum hurdle when examining existing businesses and identifying investments.

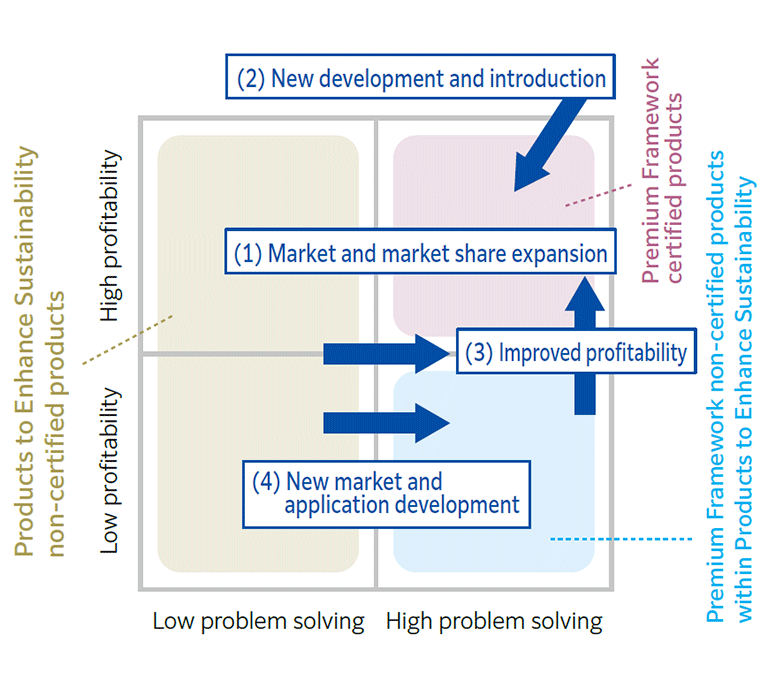

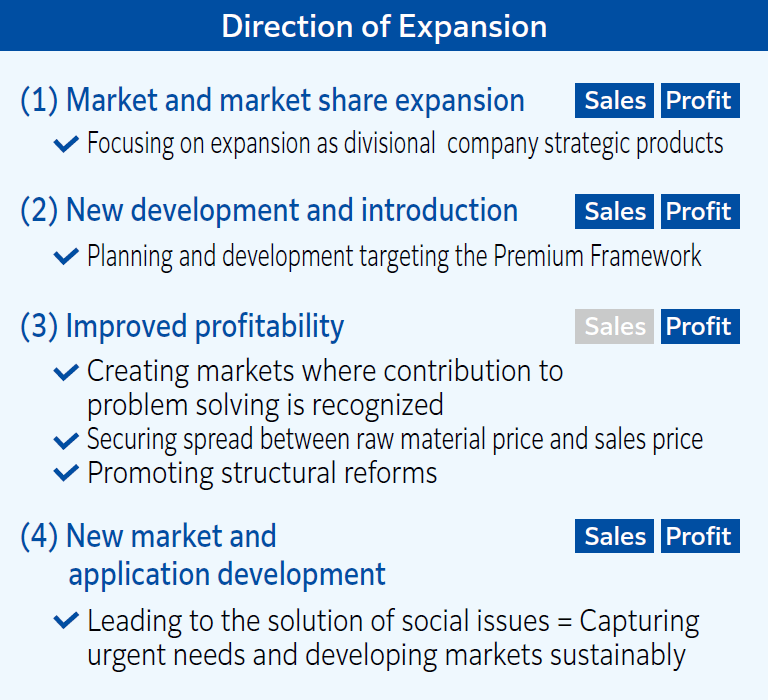

Additionally, Products to Enhance Sustainability are indispensable for the Group’s growth. Each business department is particularly focused on expanding its Premium Framework, and also emphasizes a product portfolio with social contribution and profitability as evaluation factors for each product. By creating new markets that contribute to solving social issues, we will increase the profitability of Products to Enhance Sustainability and push them into the Premium Framework.

Premium Framework Expansion Strategy

The Significance of Owning a Housing Business

I have great confidence in the level of quality of the Group’s housing, which has earned a reputation for high quality and high added value, especially as “disaster-resistant houses.” Not limited to the Housing business alone, synergies are being demonstrated with the Town and Community Development business as a whole—including plumbing, unit baths, CROSS-WAVE (a rainwater storage/recharge system), and construction that eliminates utility poles, which are Urban Infrastructure & Environmental Products. These synergies play important roles in the realization of our Long-term Vision of contributing to people’s lives.

The technologies developed in the Housing business also contribute to the creation of new businesses for the Group. For example, the knowledge of our engineers in the Housing business was utilized in the development of roof installation technology for perovskite solar cells, and we envision future deployment on residential roofs, which means that owning the Housing business will also augment the strength of the Perovskite business.

Furthermore, although it requires a certain amount of investment and ingenuity, the Housing business continues generating cash on a stable basis without major additional capital investment, contributing to the Group’s operational stability and the maintenance of a high external rating of AA-. I believe that this stability will have a positive effect on borrowing for future investment in perovskite solar cells, leading to the active use of interest-bearing debt and management with an awareness of capital efficiency.

The Housing business is a high-ROIC business with robust profit that is significantly higher than WACC, which also strongly contributes to improving corporate value. Although market conditions are challenging, the high plant-production ratio makes this business less susceptible to changes in the external environment, such as a shortage of carpenters and soaring construction labor costs, and it is expected to continue to grow in the future. We will maintain our efforts in order to convey to investors and other stakeholders this steady sense of growth.

Creating New Businesses That Are the Key to Accelerating Growth

The Group has created a strategic area map as a compass for our business strategy, and has designated areas to expand out from existing businesses as “Enhancement Areas,” while areas to create new innovations based on future trends are “Innovation Areas.” Particularly in Innovation Areas, we will accelerate progression to the commercialization phase by leveraging internal and external collaboration and M&A based on our core technologies. For example, with regard to perovskite solar cells, a new company was established in January 2025, and a 100 MW-scale production line is being set up, while cell adhesion polymer for use in stem cell cultures, including iPS cells, was launched in June. These pioneering efforts are progressing steadily.

With regard to investment, strategic capital investment is expected to exceed the budget set in the Medium-term Management Plan due to an increase in growth investment projects, such as production capacity expansion in High Performance Plastics and capital investment for the start-up of mass production lines for perovskite solar cells. We will continue to consider a wide range of M&A opportunities, with a focus on Innovation Areas. At the same time, since DX at development sites is indispensable for efficiently creating new products, our Group is focusing on improving the speed of R&D by utilizing materials informatics (MI). This is an effort to dramatically increase the efficiency of materials development through the use of machine learning and other information sciences, and significant results are beginning to emerge. For example, in the study of formulations for film products, a process that previously took five months to design a formulation was reduced to four hours, and, in the development of adhesives for tapes used in electronic materials, a process that previously took one month was reduced to 16 hours.

Enhancing Governance with an Awareness of Reducing Capital Costs

I believe that enhancing corporate governance is the most important factor in improving confidence. Our basic policy is to aim for sustainable growth and medium- to long-term enhancement of corporate value by increasing management transparency and fairness, while pursuing swift decision-making.

In terms of risk management, the Sustainability Committee identifies risks and opportunities that the Group may face in the future, including climate change, urban concentration, aging populations, and the rise of AI technologies.

I also believe it is important to set internal control as a key issue and to curb the occurrence of serious misconduct and other incidents that could significantly damage corporate value. We are working to improve our ability to prevent, detect, and respond to incidents at an early stage in five key areas: Safety, Quality, Legal/Ethical, Accounting, and Information Management. Regarding quality in particular, we are accelerating the DX of processes, from measurement to shipment determination, that do not involve any human intervention. Furthermore, we are promoting awareness of the need to reduce capital costs, and are reflecting awareness of financial and non-financial capital costs in human resource evaluations of management positions. In the non-financial sphere, we have put in place a system to quantify the impact of incidents and reflect it in evaluations as an impact on capital costs, which is also linked to bonuses.

Initiatives to Tackle Ambitious Environmental Goals

We are proud to be one of the leading industry companies in terms of environmental initiatives, having been the first chemical manufacturer in the world to acquire SBT certification and reacquire SBT certification with an even higher GHG emission reduction rate target. I believe that this is the result of not only our approach to reduce GHG emissions in our own production processes, but also our approach to reduce environmental impact with an awareness of Scope 3 emissions through the development and promotion of Products to Enhance Sustainability. Both are closely related to our initiatives on climate change and resource recycling, which we have set as key issues.

Regarding climate change, the Company’s GHG emissions reductions are on track, with a 37.9% reduction in FY2024, and a reduction target of 50% in FY2030 (versus FY2019 levels). Among other things, we have obtained SBT certification for our percentage of renewable energy to purchased electricity, with the goal of achieving 100% by 2030. At the same time, a large portion of the breakdown of GHG emissions during production is fuel-derived, such as gas and steam. With regard to the reduction of fuel-derived GHG emissions, we are moving forward with production innovations such as reviewing the distillation process and studying the use of next-generation carbon fuels, such as hydrogen and e-methane, with the aim of achieving net-zero emissions by 2050.

Resource recycling is an approach that contributes to the reduction of Scope 3 GHG emissions. We are actively working to expand sales of products made from recycled raw materials and to recycle waste plastic into new materials, which is a standard for certifying Products to Enhance Sustainability, and is also included in our evaluation indices. We are working toward the ambitious target of a 100% waste recycling rate by 2030, with a view to utilizing new technologies.

Human Capital Strategies for Fostering Employees Who Embrace Challenges

Based on the philosophy that “ employees are precious assets bestowed on us by society,” our Group places importance on “human resources that embrace challenges” and strives to create a vibrant organization where everyone is willing to take on challenges. Since the formulation of our Long-term Vision, we have been reforming our human resources system and have put in place programs to encourage embracing challenges, while at the same time securing a budget line for human capital investment and aggressively investing in reskilling and other activities.

In addition, in order to encourage each employee to continue to take on the challenge of “creation, innovation, and improvement” in the workplace, we are emphasizing human capital in terms of both investment and structure by including the Employee Challenge Action Rate in the KPIs and by establishing a system to actively promote personnel who are willing to take on such challenges. The accumulation of such efforts is the driving force behind our operating profit of over 100 billion yen, and I feel that the challenges taken by each and every employee are leading to results.

In securing human resources, we are putting forth the idea that we are not a company that people join for the sake of stability, but rather a company where they can experience personal growth through embracing challenges. We have also prepared a commercial for recruitment to convey that we are a “company where you can take on interesting challenges and experience growth,” while simultaneously communicating the message that, “We will not leave current social issues to future generations.” In the second round of recruitment messages, we highlighted our engagement in the development of perovskite solar cells, and, particularly in terms of the degree of employment interest from science students, this has steadily produced positive results.

We will continue to actively communicate our corporate stance and practical approaches to growth through solving social issues as we strive to secure and develop excellent human resources who are highly motivated to take on challenges.

A Leadership Ideal of “Leaders Who Take on Challenges with Us”

As was the case with our Group’s Long-term Vision, which was created through thorough team discussions, even though the final decision is made by the leaders, I believe that it is extremely important for all members to understand the process and share the vision of what we should be aiming for. If we can share a vision, each of us will voluntarily take up the challenge. Together with our members, we will clarify what is ideal for our organization, and, in the process of challenging ourselves to realize it, we will grow as members ourselves. The role of leaders is to encourage that growth.

Imposing on people only to “do as you’re told,” will not yield a proactive embrace of challenges. I believe that the ideal leader is one who creates an environment in which members can challenge themselves and grow, while that leader works with them to embrace challenges together.

Respecting Human Rights as Part of Responsible Global Management

The Group, which operates globally, is committed to being responsible for respecting the human rights of all people affected by its business activities, as globalization is further accelerating in the procurement of raw materials, especially those for the High Performance Plastics Company. In order to strengthen a sustainable management foundation, we regard respect for human rights as the foundation of management and are pursuing initiatives not only for employees, but throughout the supply chain, including business partners. Furthermore, since human rights violations carry the risk of significantly damaging corporate value, we are further strengthening our efforts with the earnest intention of preventing serious problems before they occur.

Based on this mindset, we established a Human Rights Subcommittee in FY2022 under the Sustainability Committee, which I chair, and this subcommittee is responsible for formulating Group-wide policies on human rights. Through the four working groups under the Human Rights Subcommittee, we established mechanisms for human rights due diligence within the Group and for human rights due diligence of business partners, as we work to identify and correct issues. Furthermore, we provide human rights education, and established whistleblower and consultation contact points accessible to a wider range of stakeholders, including foreign employees.

Shareholder Dialogue That Leads to Increased Corporate Value

I believe that dialogue with shareholders, investors, and other stakeholders is extremely important. Just as in the past, I conscientiously take the opinions and suggestions received through these dialogues and use them in management. Recently, we have received many questions and opinions from shareholders, especially those with long-term holdings, on issues such as growth strategies, capital policies, our business portfolio, and ESG management.

I believe that increasing the number of shareholders who become fans of our Group is the most important factor for sustainable enhancement of corporate value. Based on sound management with effective governance, we will steadily build up our business performance, disclose appropriate information, and continue to place importance on dialogue with our shareholders and investors. Although I sometimes receive unfiltered opinions in the course of dialogue, I believe that frank and honest opinions are what we should appreciate, as they often provide hints for future improvement in our efforts to enhance corporate value over the medium to long term.

SEKISUI CHEMICAL Group Today and the Challenges I Embrace as President

Are we able to maintain a “healthy sense of urgency?” I feel that this question captures the current challenge facing the Group. Although we achieved record performance in FY2024, it is easy to become more complacent when things are going well. Becoming satisfied with the status quo is the beginning of the descent. Performance begins to deteriorate, the Company goes on the defensive, and we lapse into a contractionary equilibrium. That is the situation that should be avoided most for companies seeking sustainable growth. It is precisely when things are going well that we need to have a sense of urgency and be ready for the next round of preparation.

What I must do now, then, is foster and instill a “culture of challenge” throughout the Group. The percentage of employees who said they “embraced challenge” in FY2024 is still in the 50% range, albeit up 8 percentage points from the previous year. If this number increases to 70% or 80%, I am confident that we can evolve into a company with overwhelming growth potential.

My greatest challenge is to instill a culture of continuous openness toward embracing challenges. I remain fully committed to the sustainable growth of our Group and our employees.